The Ultimate Guide To Empty Home Tax Bc

Table of ContentsMore About Empty Home Tax BcThe 6-Minute Rule for Empty Home Tax BcGetting The Empty Home Tax Bc To WorkEmpty Home Tax Bc Things To Know Before You BuyNot known Factual Statements About Empty Home Tax Bc The Definitive Guide to Empty Home Tax Bc

Pursuant to the Job Tax Obligation Bylaw, the Enthusiast of Taxes might audit approximately two years after the applicable openings recommendation period as well as request a proprietor to provide proof or info to sustain a home standing. If the Collector of Tax obligations assesses the evidence or info and also identifies that the affirmation was false, after that the building would certainly undergo the tax.All buildings will have a note within both the Residential Property Questions Report as well as the Account Balances Record that states, "Any obligation for Openings Tax is not consisted of as component of this record. To find out more on Openings Tax, check out For questions, call 3-1-1".

The Greatest Guide To Empty Home Tax Bc

This will figure out the house's occupancy standing and also whether the uninhabited house tax is payable. If a building owner states their house(s) vacant, they will certainly be needed to pay a tax obligation at oneper cent of their residence's Current Analyzed Worth (CVA).

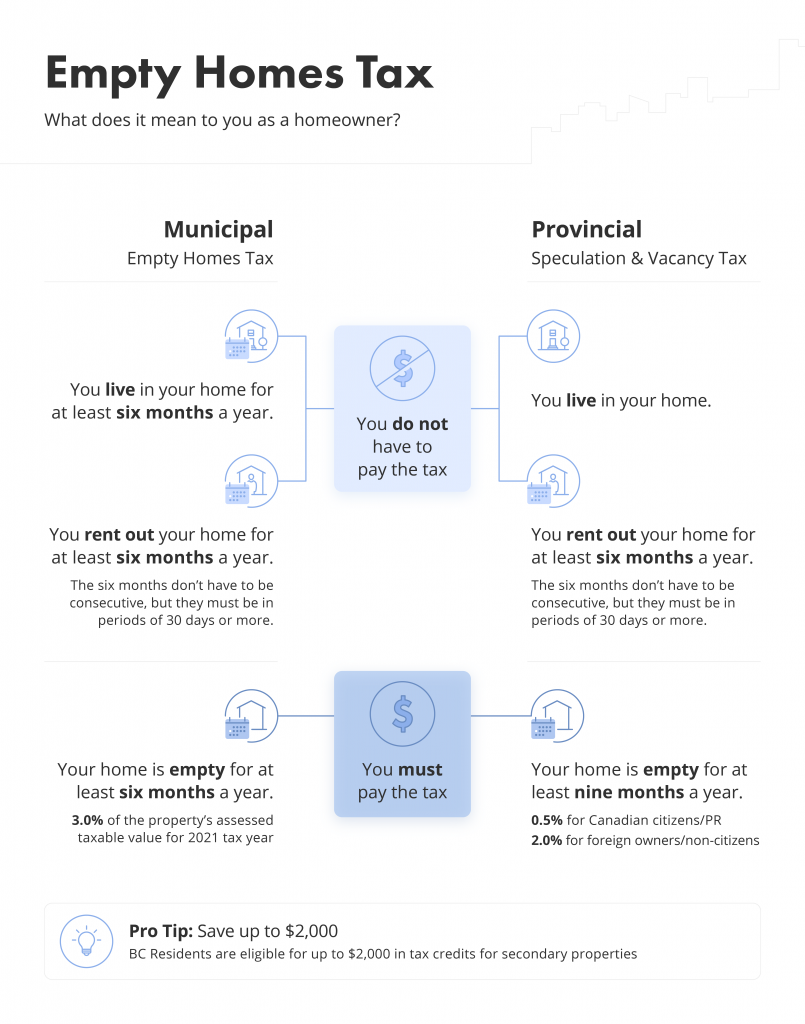

A device is taken into consideration vacant if it has actually been vacant for more than 6 months during the previous fiscal year, as well as the device is not the primary home of the owner, or it is considered to be uninhabited under the by-law. Some exemptions may use. Exemptions & Audits There are a variety of situations where a residence might be uninhabited for a prolonged time period.

Some Known Questions About Empty Home Tax Bc.

In reality, there are a variety of methods my link in which you can be thought about exempt. For example, many home owners will not go through the tax, as it does not relate to major residences or homes that are rented on a long-term basis. If your home is occupied for 6 months of the have a peek at this site year however uninhabited for the rest, you additionally do not require to pay.

Here are a few important things to bear in mind: Also if you are not required to pay the tax, you still must make a residential or commercial property status declaration for the 2017 fiscal year. Failing to do so will certainly lead to your house being declared empty and you will undergo the 1% vacant house tax, plus an additional $250 cost.

Little Known Facts About Empty Home Tax Bc.

Incorrect statements will lead to penalties of approximately $10,000 per day of the continuing offense, along with repayment of the tax. The City is trying to motivate some type of positive adjustment, many people are not encouraged that the empty houses tax obligation will move the dial when it comes to freeing-up added homes that can be rented.

Whatever your ideas on the vacant homes tax, it's important to comprehend just how it impacts you, we can assist.

The B.C. federal government introduced the growth of locations where the conjecture and also job tax uses. The conjecture and openings tax obligation is an annual tax obligation based on exactly how owners use household buildings in major urban locations in B.C.

Over 99% of British Columbians are exempt from the speculation and vacancy go taxOpenings, you may be eligible for a tax obligation debt to minimize the amount of tax you have to pay.

You can pay the tax obligation anytime after you receive a Notice of Evaluation in the mail, which will show the quantity of speculation and also vacancy tax obligation you owe. After you declare, a Notification of Assessment will certainly be produced and sent by mail to you if you owe the tax. When we establish you owe an amount under the supposition as well as vacancy tax, we send you a notification detailing the amount owing and also exactly how to pay it.

The Best Strategy To Use For Empty Home Tax Bc

If you obtained a Notice of Analysis for the conjecture and vacancy tax and think an error was made you have a number of choices to get assistance. Any person that has to declare for the supposition and vacancy tax might be audited.

5 per cent for the 2021 tax obligation year, was implemented by the previous council to urge homeowner with uninhabited residences to open them up for rental fee in Vancouver instead of be strained. Stewart informed council the CMHC information demonstrates how the empty houses tax obligation in mix with company licensing requirements and limitations for short-term leasings such as Airbnb is having the preferred effect on moving uninhabited condominiums onto the rental market.